[6 / 3 / 1]

Quoted By:

There’s a concept called in infinite divisibility. It’s where if you have a whole and split it in half then slit the half in half and then split the half in half again you’d never finish cutting and would just get smaller and smaller parts.

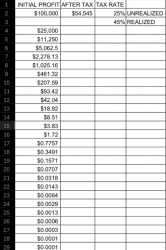

If you applied this to an unrealized capital gains tax if someone had an unrealized profit they would have to sell then realizing a gain and would have to sell again to pay for the tax on the gain if you wanted to just use the profit to pay the tax. You’d never finish selling to pay the final tax unless you used outside capital to pay off the final amount. Your profit would eventually bleed to close to zero but never zero and you’d never be able to stop the process.

I put it in a spreadsheet and the numbers get really small but just doing that process 20 or so times it brings the effective tax rate to 45% all because of the unrealized gain.

Pretty gay

If you applied this to an unrealized capital gains tax if someone had an unrealized profit they would have to sell then realizing a gain and would have to sell again to pay for the tax on the gain if you wanted to just use the profit to pay the tax. You’d never finish selling to pay the final tax unless you used outside capital to pay off the final amount. Your profit would eventually bleed to close to zero but never zero and you’d never be able to stop the process.

I put it in a spreadsheet and the numbers get really small but just doing that process 20 or so times it brings the effective tax rate to 45% all because of the unrealized gain.

Pretty gay