>>80367852>Share buyback would be the last thing you'd want to see from a company in its growth stage.If you think your stock is going to go up because you believe in the company success it's "fine" to buy your own shares, it's not really money you lose, for all intents and purposes is still an asset you can use to do whatever, you can sell them back for money, you can use it to buy other companies, you can use them as leverage to take loans, etc. Having straight up liquid cash makes no sense for any company, especially in this case when the yen going down in value dramatically, you will have that money in some investment fund that returns a profit, and that's essentially made up in shares, bonds, etc. Doing it with your own shares is no different but it's obviously way more risky.

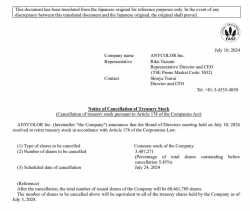

Now cancelling your entire owned stock is a different deal, because the only way to get that money back is issuing more shares to sell them, and that won't happen if the investors do not believe in the company. So this move essentially has two realities, it's either investors deciding to divide the company's profits among themselves so they drain it as much as they can before exiting and thus the company is fucked, or they are trying to bait new investors to keep the company afloat.

It's up to you to decide which one is it.